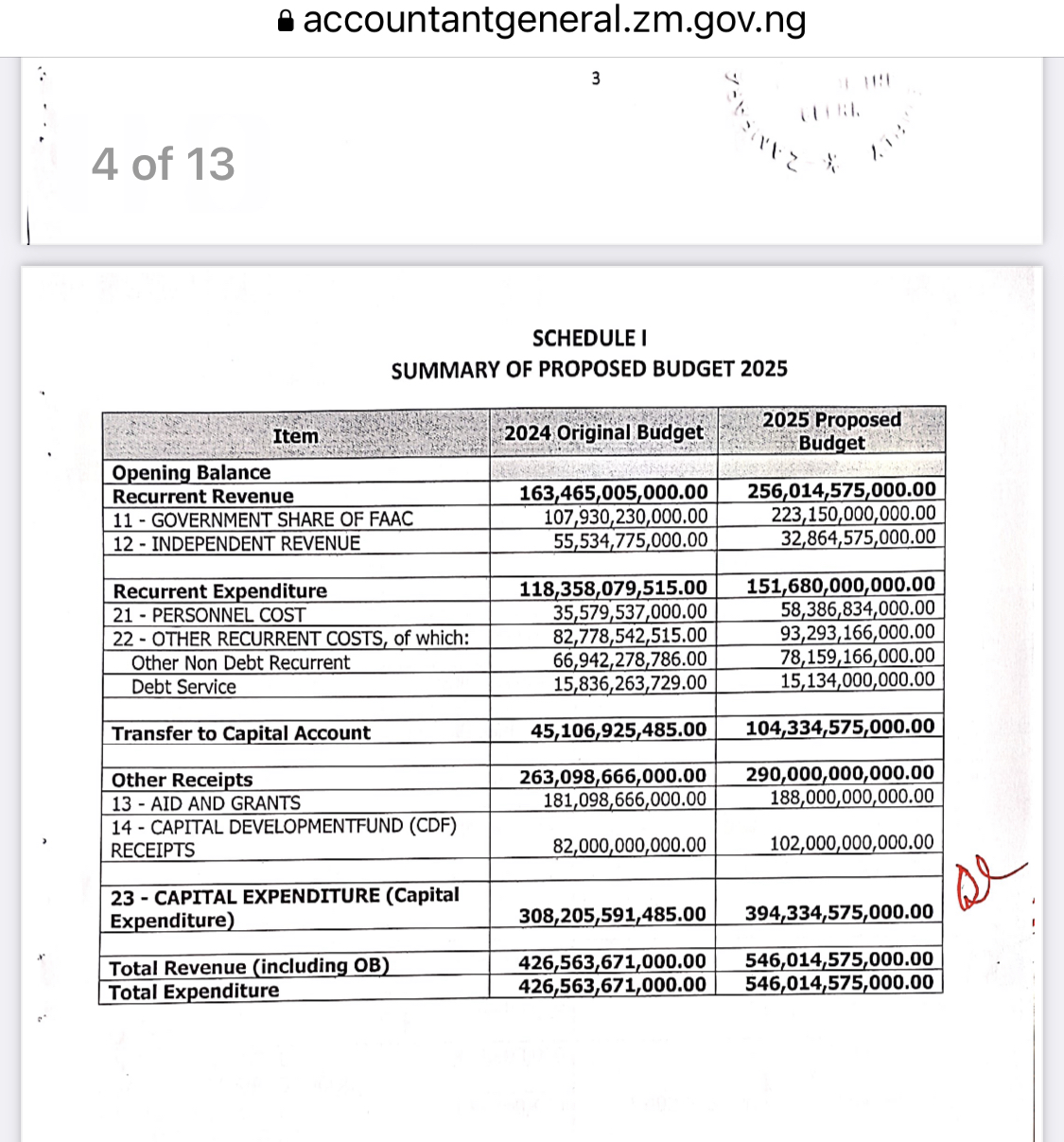

Zamfara State faces a daunting financial challenge as it plans to spend N546 billion in the 2025 budget while only generating N32 billion internally, just 5.8% of its total expenditures. Governor Dauda Lawal has endorsed this budget, earmarking essential sectors like security, education, health, and infrastructure. The state heavily relies on federal allocations of N223 billion to cover gaps, raising concerns over its minimal revenue generation. Source

If Zamfara opts to pay salaries solely from its internally generated revenue, it could only fulfil 55% of payroll obligations in 2025. This issue highlights the broader problem of Nigerian states’ dependence on federal funds and loans, exacerbating debt and limiting development potential. Worryingly, Zamfara’s domestic and foreign debts are mounting. This fiscal struggle calls for innovative revenue solutions and fiscal responsibility to ensure sustainable growth. Source

- Key Takeaways:

- Zamfara’s Budget Deficit: Relies heavily on federal revenues, highlighting the need for more self-sufficient financial strategies.

- Fiscal Responsibility: The state must explore diverse revenue sources to reduce debt and ensure economic stability.

- Impact on Development: The reliance on external funds could hinder long-term development plans.

Question for Readers: How can Nigerian states like Zamfara reduce dependence on federal allocations and loans to achieve fiscal sustainability? Share your thoughts!