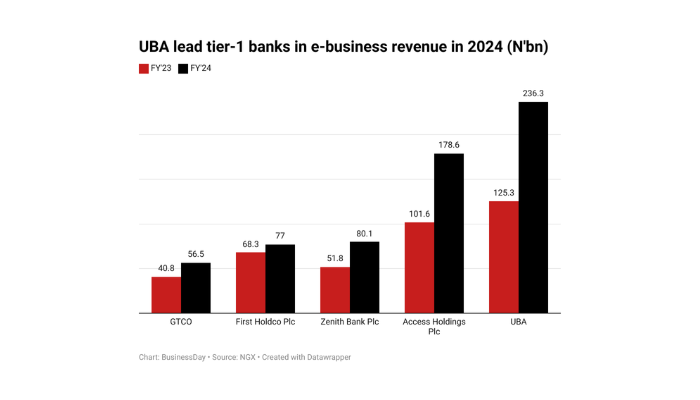

In Nigeria news, the total income from electronic businesses in the country’s five largest banks surged by 51% to N628.5 billion in 2024, from N387.8 billion in 2023. The increase reflects Abuja news on the growing use of digital channels like debit cards, mobile apps, and POS systems. Among the banks, UBA led, posting N236.3 billion in e-business income.

Access Holdings and Zenith Bank followed UBA, earning N178.6 billion and N80.1 billion, respectively. As per the Nigeria Inter-Bank Settlement System, electronic transactions skyrocketed to N1.08 quadrillion in 2024, reflecting increased digital adoption. This growth indicates banks are capitalising on this trend, benefiting from rising transaction volumes.

Key Takeaways:

- UBA topped in e-business earnings with an 88.5% growth.

- Electronic transactions reached an all-time high of N1.08 quadrillion in 2024.

- POS transactions in Lagos news increased 81% to N19.4 trillion.

Read more details on BusinessDay.

Discussion Point: How do you see the future landscape of digital banking in Nigeria evolving in the next few years?