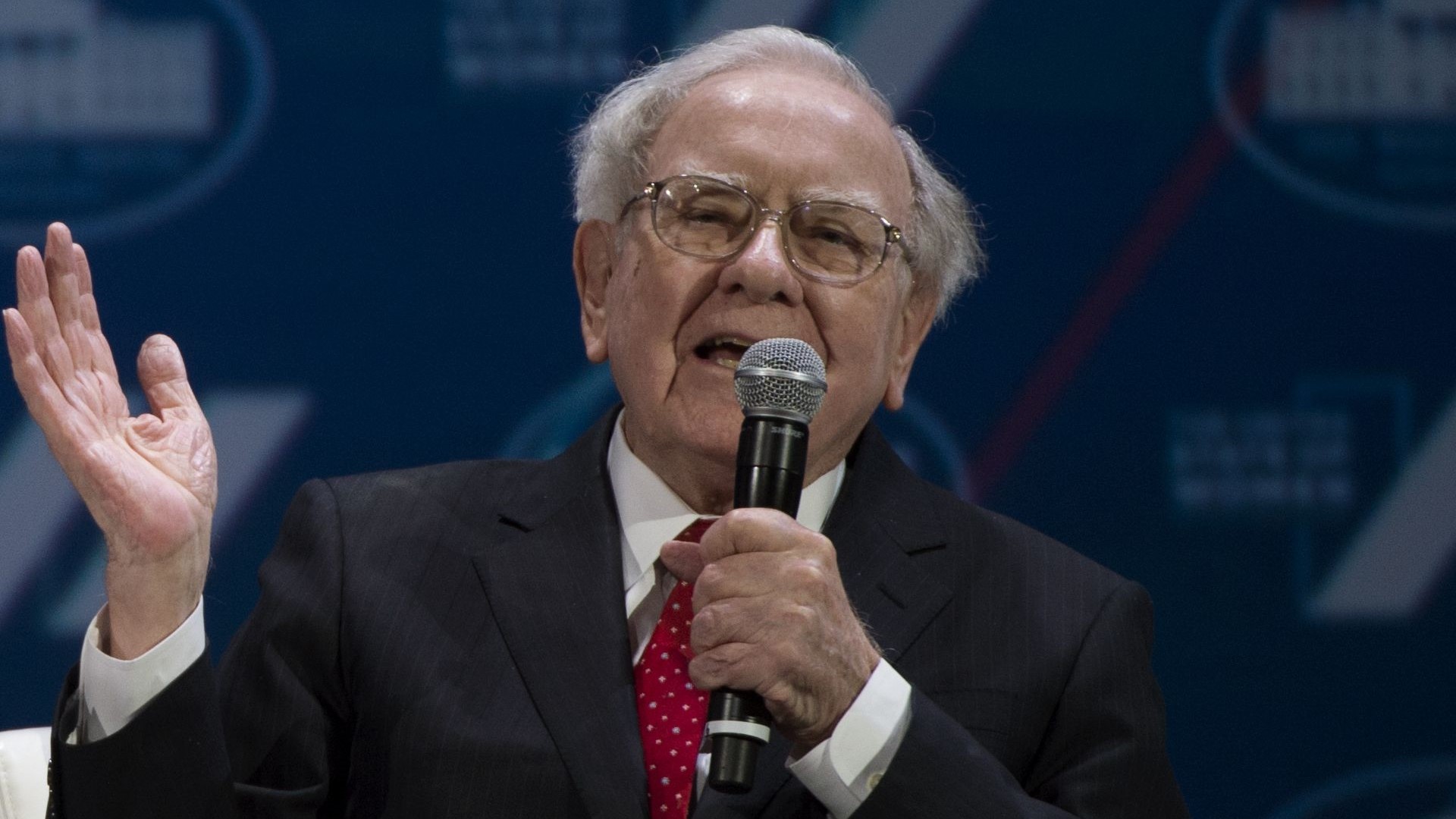

Warren Buffett’s recent letter to shareholders highlights timeless financial wisdom, from embracing mistakes to prioritising long-term investments. He praises Greg Abel, likening him to the late Charlie Munger. Buffett’s commitment to lifelong learning and the value of innate talent over educational pedigree resonates globally, including here in Lagos news. Read the full article here.

Buffett underscores the importance of paying taxes, stating it’s good for society. He mentions Berkshire’s substantial IRS payments, hoping for higher in the future. His message is universal: financial gains are a long-term endeavour. This guidance, relevant to investors worldwide, enriches Abuja news with insights on responsible capitalism.

Key Takeaways:

- Embrace mistakes and act timely.

- Evaluate talent beyond formal education.

- Prioritize long-term investments and responsible tax payment.

What are your views on Buffett’s approach to investment and social responsibility? Share your thoughts below!